Obtaining the Best of Both Worlds

By RWML

You’ve placed your hands on some extra USD cash and you’re wondering if you should put it under your mattress, in a savings account, or even try investing in stocks and bonds. All investments are risky, whether the local stock market or even the international stock market. But, the level of risk exposure is entirely up to you.

What is the International Stock Market? Where do you even begin? Well, the International Stock Market is similar to our known vegetable markets. It’s a place that facilitates the regular buying, selling and issuance of international stocks publicly. This is also called trading.

If you’re a seasoned investor with time on your hands to study financial statements and actively follow the market, you may know exactly which investments to make. But if you’re a now beginning to invest or if you don’t have the ability or time to follow the market on a regular basis, the mere thought of having to pick your investments may scare you from getting started. Here’s a little secret, rather than selecting international stocks individually, what if I told you that you could buy one security that could provide you with an exposure to a large bundle of investments? Well, the good news is that this type of investment exists and is called an Exchange Traded Fund also called ETF for short. An ETF is basically a basket of securities that trade on an exchange, exactly like a stock and they generally follow or track a particular broad index, for example, the S&P 500 or the Barclays U.S. Aggregate Bond Index. ETFs can be bought and sold throughout the day on the exchange just like an individual stock. ETFs can provide exposure to many types of asset classes, including stocks, bonds and commodities and to market sub-sectors including investment grade bonds, specific stock market sectors (e.g. financials or energy) or regions (e.g. U.S.A, Latin America).

Don’t be turned off by this three-letter acronym. It can be a valuable tool for investors getting started or a new addition to experienced investors. Let’s now plunge into the pros and cons of ETFs:

Pros:1. Small Investment Amounts: One of the best features of ETFs is that it’s ideal for individuals with small amounts of capital to invest because it pools together the money of many investors to invest in a basket of securities that include stocks, bonds, commodities and many more.

2. Traded Throughout the Day: ETFs can be bought and sold throughout the day on the International Stock Market. It is therefore seamless to realize the gains you’ve made on your investment or to liquidate to meet unplanned needs that may pop up from time to time.

3. Diversification: When you invest your money in an ETF, you are effectively purchasing a diversified basket of securities. For example, if you buy an ETF that tracks the S&P500 index, you are investing in a basket equivalent to holding the 500 shares in the index. But what’s so great about that? Well, by buying a basket of securities, you are diversifying your portfolio. What this means is that your investment will not be significantly affected by one particular asset going up or down in price. If you attempted to diversify your portfolio individually it will be extremely costly and require immense effort to buy all the components of a particular basket. ETFs make the diversification process easy. It’s like the best of both worlds.

4. Low cost: Another attractive feature most ETFs bring to the table is the possibility of lower cost. As most ETFs are passively managed, they charge lower fees than a typical actively managed Fund.

5. Transparency: There are thousands of ETFs of various sizes worth trillions of dollars. In the United States during 2002 to 2020, total net assets of ETFs increased from US$102 billion to US$5,449 billion. Anyone with Internet access can search the price activity for a particular ETF on an exchange. Unlike mutual funds that disclose its fund holdings monthly or quarterly, most ETFs disclose their fund holdings daily to the public.

Cons:

1. Non-ownership: When you buy shares in an ETF, you won’t be given any voting rights. Do recall that you and other individuals combined your money to purchase this diversified basket called an ETF. As such you and the other individuals own a portion of the ETF rather than the underlying assets that make up the fund. Don’t be alarmed, this doesn’t affect your profits in any way.

2. Potential liquidity issues: Liquidity is basically the ability to convert your investment into cash. The ETF market is large and diverse, with 2,204 ETFs amounting to approximately US$5.45 trillion at year end 2020. Many of these ETFs trade millions of units daily and thus provide ample liquidity to investors seeking to liquidate their holdings. However, there are also many ETFs that aren’t frequently traded and may be difficult to sell at quick notice. As a result, it’s usually recommended to select an ETF with a higher liquidity.

3. Performance Risk: Most ETFs will not significantly outperform the markets they track since they mirror the movement of a particular market.

4. Underlying Market Price Fluctuations: ETFs provide diversification but do not insulate from overall market movements. Basically, if the broad market index falls, then the ETF unit price will also fall. Similarly, if the market rises, so will the ETF price. However, an ETF that tracks a broad market index such as the S&P 500 is likely to be less volatile than an ETF that tracks a specific industry or sector as an oil services ETF. A key point to note before selecting an ETF to invest in is to ensure you research and purchase the one that suits your exposure and liquidity (ease of encashment) needs. Remember, your Financial Advisor is here to help!

Now you might be having mixed emotions about ETFs given the pros and cons. But, ETFs have grown in popularity primarily driven by investors utilizing it as a mechanism to gain access to a diversified basket of securities that track a particular asset class, index or industry sector. Let’s look at two examples of ETFs below:

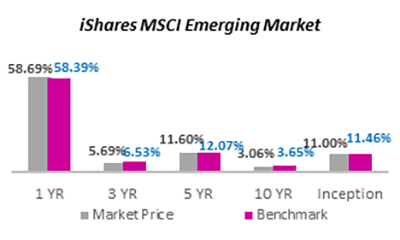

A. One of the most popular ETFs in the world is called the ‘iShares MSCI Emerging Markets ETF’. It’s one of the oldest ETFs that offer exposure to stock markets of emerging economies. This ETF fund size is approximately US$30.6 billion. Let’s take a look at how it performs and compare it to its benchmark[1] for a better understanding.

From the chart above we can see that the ETF’s performance varies over different periods, however, it is very similar to the benchmark in each period.

B. Another example on a fairly new ETF is the ‘Vanguard S&P 500 UCITS ETF’. This ETF commenced in May 2012 and tracks the performance of a specific index called the S&P 500 Index. This ETF’s fund size is approximately US$32 billion. Let’s dive into how this ETF performs in comparison to its benchmark.

[1] A benchmark is a standard against which the performance of a security, mutual fund or investment manager can be measured.

Similarly, from the chart above this ETF also performs in line with its benchmark.

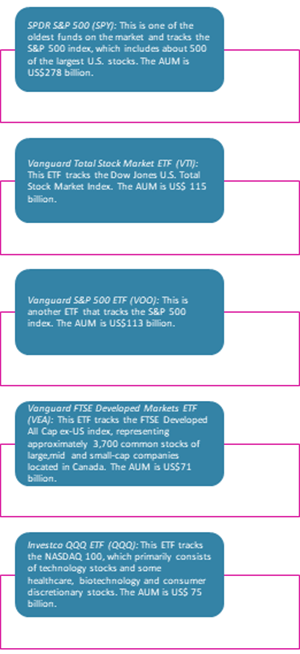

The most popular ETFs usually have the highest assets under management (AUM). Here’s a list of the 5 most popular and largest ETFs.

Remember, you can easily create an ETF portfolio by including a variety of different types of ETFs. An example of an ETF portfolio would include 60% equity ETFs and 40% bond ETFs.

You now have a plethora of information on ETFs. But remember, ETFs aren’t a ‘one size fits all’ solution to investing. Everyone’s investing style is unique. Your priorities will also change throughout your life and it is important to adjust your investment portfolio to suit these evolving needs. Your Financial Advisor will help guide you through this process. Happy investing!

By:

Contact

- invest@rfhl.com

-

868-625-3617

Ext. 69919, 69914, 69913, 69911, 69903, 69918 - #8 Rapsey Street Ellerslie Plaza, Maraval. Trinidad and Tobago.

-

For Financial Statements

868-625-3617

Ext. 69907, 63390

©2026 - Republic Wealth Management Limited | All rights reserved