Guilt-Free Budgeting

By RWML

We all want to save money.

Typically, the go-to solution is to create a budget and cut down on your expenses. This, according to many financial experts, is the key to financial freedom. But the reality is, this approach doesn’t work for everyone and can leave some of us feeling stuck, frustrated and no closer to reaching our financial goals.

What’s the purpose of personal budgeting?

A personal budget is an important tool that helps you know how much money you have available for spending and saving. It allows you to determine in advance whether you’ll have enough money to do the things you need or would like to do. Without one, it’s often impossible to meet all your financial responsibilities, and there is a greater chance of facing serious financial problems, such as high debt, repossession, or bankruptcy.

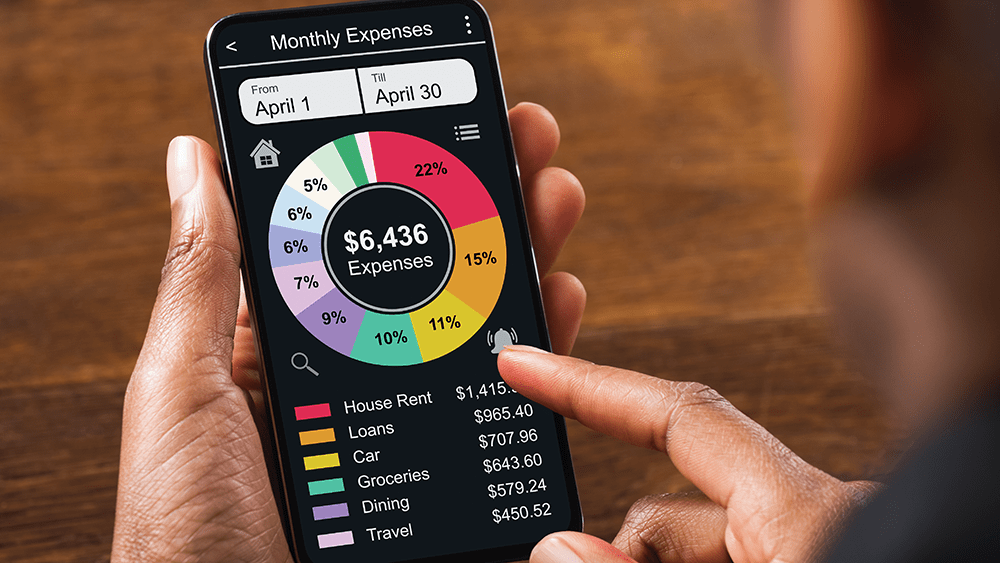

One of the major goals of a budget is to minimise expenses and maximise savings and your personal budget should detail your monthly income and expenses. The key here is to make sure your expenses don’t exceed your income. With it, you’ll have a bird’s eye view of:

– Where your money goes each month

– Incoming bills to ensure they’re paid on time

– A clear idea of your needs versus wants and desires

– Where you may need to cut out unnecessary expenses

– How much to set aside money for savings each month

So, why do budgets fail?

Depending on your preferences and where you’re at in your life, traditional budgets can be useful if you’re trying to reduce overspending, but the approach doesn’t always work for everyone.

Why does this happen?

One of the main pitfalls for people who abandon budgets is that they go from no budget at all to trying to cut spending dramatically and setting impossible goals.

They get so restrictive with spending that they either ignore or forget to cater for some of life’s curveballs and the budget doesn’t allow for it: this can range from an upcoming birthday gift or dinner to emergencies.

More often than not, they throw in the towel because they’re unable to live within their means, feel guilty for spending outside of what the budget caters for and are left disappointed without seeing any real gains.

Consider a conscious spending plan instead

It’s great to be ambitious about paying down debt or saving up for a big purchase, but you must make sure your budget creates flexibility on the road to accomplishing those goals.

That said, you may want to reassess your approach. Instead of focusing only on where to cut your spend, consider consciously spending. The rationale for this is to foster positive spending habits instead of stopping yourself from spending altogether. In essence, it’s about creating a big-picture plan of how you will allocate your spend.

One of the best ways to approach this is with the 50/30/20 Rule, which can be broken down like this:

50% – Fixed Costs (what you need to live)

Set aside 50% of your earnings for the things you must pay for each month. This includes necessities like rent/mortgage payments, car payments, loan repayments, insurance, food, and utilities.

20% – Investments and Savings (for future you)

Set another 20% aside of your earnings to go towards important investments in the future, like life savings, down payment on a home, pension, or an emergency fund.

30% – Towards guilt-free, fun spending

The last 30% of what’s left is meant for flexible spending that includes things like eating out, entertainment and shopping. The reason it should be guilt-free is that you’re now empowered to spend on the things that you enjoy because the major expenses for today and the future have already been taken care of. Automating or setting up standing orders can also go a long way in ensuring that you stay on track with your varied expenses.

When it comes to creating a budget, it isn’t a matter of one-size-fits-all but instead, what matters most is setting up one that works for you and helps you meet your goals.

One approach to consider is setting up a conscious spending plan; the goal here isn’t to limit you, but instead, help you increase awareness about your spending habits; it can also take away the burden of feeling guilty for spending or not feeling too overwhelmed if any unexpected expense comes your way.

When you start to connect your spending to your values and goals and make room for adjustments, you’ll achieve more satisfaction by building healthy, long-term financial habits.

Contact

- invest@rfhl.com

-

868-625-3617

Ext. 69919, 69914, 69913, 69911, 69903, 69918 - #8 Rapsey Street Ellerslie Plaza, Maraval. Trinidad and Tobago.

-

For Financial Statements

868-625-3617

Ext. 69907, 63390

©2026 - Republic Wealth Management Limited | All rights reserved