©2025 - Republic Wealth Management Limited | All rights reserved

The Trinidad & Tobago Economy – Review and Outlook

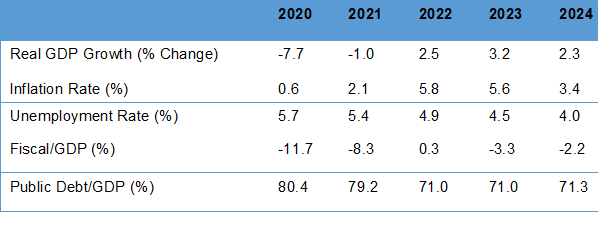

The domestic economy returned to growth in 2022, due to a combination of elevated energy prices, greater gas production and increased output in the non-energy sector. Against this backdrop, the rate of unemployment fell to 4.9 percent from 5.4 percent in 2021, even as rising inflationary pressures curtailed economic activity. Overall, real GDP is estimated to have expanded by 2.5 percent in 2022, following consecutive contractions of 7.7 percent and 1 percent in the previous two years. Because of the considerable increase in inflation, nominal GDP rose by 14 percent, causing a noticeable fall in the country’s debt-GDP ratio. As encouraging as this latest performance was, at an estimated $153.3 billion, real GDP remained $10.4 billion dollars below 2019 levels, which itself was a year characterised by a feeble 0.1 percent expansion and followed two years of economic shrinkage. Even so, the 2022 expansion has generated some optimism, notwithstanding the ongoing challenges facing the domestic and global economies. This article provides a brief review of recent economic developments and an outlook for the next 18 months or so.

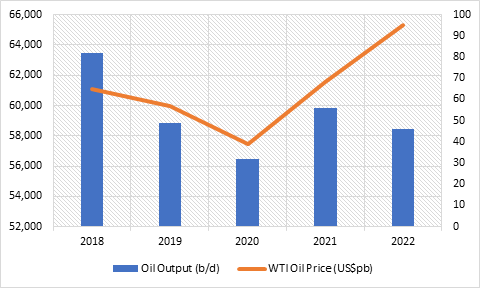

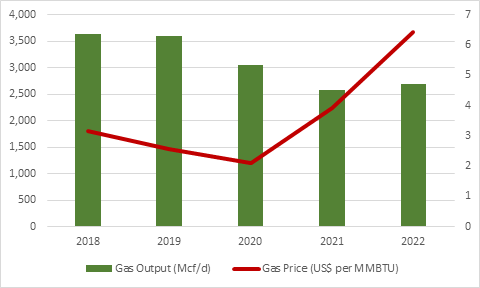

In 2022, the energy sector recorded a mixed performance as it relates to production, with oil output falling by 2.4 percent to 58,436 barrels per day (Figure 1) and natural gas yields rising by 4.2 percent to 2,688 million cubic feet per day (Figure 2). The rise in gas output was related to the launch of new projects in 2022 and the second half of 2021, including BPTT’s Matapal, Shell’s Colibri and DeNovo’s Zandolie. While the production of Liquefied Natural Gas increased during the year, the overall trend in the downstream sector was in the opposite direction. In this regard, the sharp rise in prices (due largely to the Russia-Ukraine war) was the principal driver of the increased receipts from the energy sector in 2022. The West Texas Intermediate (WTI) oil price averaged US$94.91 per barrel (pb) in 2022, up 39.1 percent from the previous year, while Henry Hub gas prices shot up 64.2 percent to US$6.42 per million British thermal units (MMBTU). It should be noted however, that while these benchmark prices are often referenced as a gauge for the market realities facing domestic energy exports, Trinidad and Tobago’s oil and gas normally trade at prices above the WTI and Henry Hub averages.

Figure 1: Oil Production and Prices

Source: MEEI, EIA

Figure 2: Gas Production and Prices

Source: MEEI, EIA

Although some sub-sectors continued to struggle, the increase in overall economic activity in the non-energy sector when compared to 2021 was encouraging. Preliminary data from the Central Statistical Office (CSO) suggest robust growth in non-energy manufacturing, powered by the food, beverages and tobacco sub-sector, which was estimated to have grown by 28.2 percent in the first nine months of 2022. Growth was also recorded in the trade and repairs, and the transport and storage industries, which benefitted from the removal of COVID-19 restrictions. While initial estimates point to a 3.3 percent decline in construction activity in the first three quarters, the 4.1 percent increase in domestic cement sales for all of 2022, suggests that the sector may have registered a positive performance, or at least a smaller contraction. The improved performance of the non-energy sector was also reflected in the expansion of retail sales, with the associated index expanding by an average of 17.1 percent in 2022. However, it should be noted that global inflationary pressures contributed measurably to the rise of the index. Among the categories with the strongest growth were construction materials and hardware, household appliances, furniture and other furnishings, and textile and apparel.

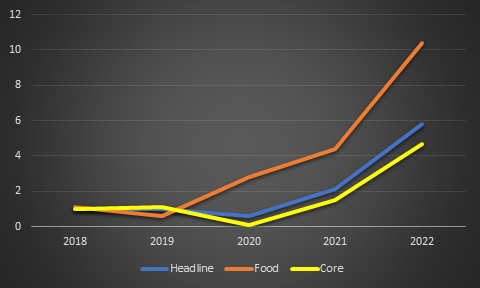

While hydrocarbon-producing nations benefitted directly from the substantial rise in international energy prices, they, like the rest of the world, suffered because of the knock-on effects, including increased shipping and transportation costs, which contributed to the rapid acceleration of global inflation. This was accompanied by record price increases in several food commodities (an unfortunate consequence of the Russia-Ukraine war) which, together with higher energy costs, eroded household purchasing power. The domestic economy was not insulated from the impact of rising prices, as headline inflation rose to 5.8 percent from 2.1 percent in 2021, with advances in both the food and core components. In 2022, food prices increased by an average 10.4 percent compared to 4.4 percent in the previous year, while core inflation climbed to 4.7 percent from 1.5 percent (Figure 3).

Figure 3: Inflation Rate (%)

Source: CBTT

Despite the rise in inflation, the Central Bank of Trinidad and Tobago (CBTT) held its policy rate, the Repo, at 3.5 percent, where it has been since the first quarter of 2020. The CBTT, being mindful of the still fragile state of the domestic economy, continued to focus on facilitating growth in the non-energy sector. As such, it decided not to take action that could cause lending rates to increase and thereby hinder the recovery of non-energy industries. The CBTT has maintained this stance in the face of significant and increasing external pressures however. The Bank’s counterparts in the US and Europe have executed robust policy rate increases in their continued battle to reverse the advance of inflation. In the case of the monetary policy adjustments in the US, they have caused the spread between US and domestic short-term interest rates to move into negative territory rapidly, reaching -429 basis points in February 2023. This places considerable pressure on the CBTT, since the more attractive rates in the US could result in capital flight, as domestic investors seek higher returns. Consequently, domestic investment and medium/long-term growth could be negatively affected.

With oil and gas prices in 2022 significantly above the budgeted US$65 pb for oil and US$3.75 per MMBTU for gas, government received an unexpected fiscal boost. During the year, energy sector revenue rose to $29.7 billion from $12.5 billion, pushing the fiscal balance to a small surplus (0.3 percent of GDP) from a deficit equivalent to 8.3 percent of GDP in 2021. After measuring $36.4 billion in 2021, total revenue climbed to $53.5 billion a year later, outweighing the 6.6 percent increase in total expenditure to $52.9 billion. Turning to public debt, the significant growth in nominal GDP, caused the figure to fall to 71 percent of GDP in 2022 from 79.2 percent a year earlier.

Outlook

The IMF projects the domestic economy to expand by 3.2 percent in 2023, with growth in both the energy and non-energy sectors. However, given unfolding global and domestic events, including the effect of ongoing monetary tightening in major economies and some uncertainty regarding domestic gas production, the expansion could register at a rate closer to that of 2022 (2.5 percent). It should also be noted that even if IMF’s forecast materialises, the economy would still be operating marginally below pre-pandemic levels.

The energy sector is expected to lose some momentum in 2023, with weaker global growth and the reduced influence of the Russia-Ukraine war, expected to contain prices, even in the face of moves by OPEC+ to cut its oil output by 1.2 million b/d between May and December 2023. Accordingly, WTI oil and Henry Hub gas prices are expected to fall by 22.4 percent and 54.7 percent, to US$73.62 pb and US$2.91 per MMBTU, respectively in 2023. However, as noted earlier, domestic oil and gas exports are expected to fetch higher prices than these benchmarks on the international market. For instance, because the average price the country receives for its gas exports is partly based on the European and Asian benchmarks, which are usually above Henry Hub (the North America benchmark), it received an average sale price of US$6.98 per MMBTU between October 2022 and March 2023, compared to the average Henry Hub price of US$4.10.

On the production side, gas output is likely to increase slightly during the year, with new output from the Cascadura field (majority owned by Touchstone Exploration Ltd) scheduled to come onstream by June 2023. As it relates to oil, the Royston-1X project owned by Touchstone and Heritage Petroleum Co. Ltd, represents the main hope of any meaningful increase in production over the short-term. With the well currently being evaluated, the first of five planned production tests disappointingly revealed non-commercial rates of light petroleum. However, Touchstone’s leadership have expressed their continued optimism regarding the well’s commercial viability. Soon after it announced the find, the company indicated that the well had the potential to produce 6000-10,000 barrels per day, which could be released almost immediately given the infrastructure already in place. Should subsequent tests confirm the well’s viability, new production is unlikely to be available from this source before deep into 2024 and may also register at lower levels than initially envisaged. Given the foregoing, the energy sector may record a negative performance in 2023.

In the non-energy sector, government’s decision to increase its capital expenditure from $4 billion to $6 billion in the 2022/2023 budget could prove to be critical, providing that it is successfully implemented. The associated increased project execution would energise the construction sector. However, given the nature of the industry, there is also likely to be significant spill-over opportunities for several other non-energy industries. Even so, given the country’s less than stellar record in project implementation, the underperformance of the sector in 2023 will be no surprise. Regarding the manufacturing sector, it is expected to benefit from increased domestic demand and the continued recovery of CARICOM economies, which together are Trinidad and Tobago’s largest market for merchandise exports. Improved performances are also expected in most other non-energy industries, with the creative sub-sector expected grow appreciably in 2023, given the re-opening of entertainment spaces and the return of major festivals in the wake of the removal of COVID-19 restrictions. Further, moves by government to settle part of the $7.8 billion in outstanding VAT refunds to companies are expected to provide a fillip to the non-energy sector. It will likely help to ease the financial challenges facing many firms, facilitate the purchase of raw materials and other inputs and allow firms to settle arrears with suppliers. Government plans to issue $3 billion in bonds to refund companies owed more than $250,000, while firms that are owed this amount or less will receive cash payments.

Government used the occasion of the Mid-Year Review to supplement its 2022/2023 budgeted expenditure with an additional $3.85 billion, taking total planned spending to $61.53 billion. At the same time, the Finance Minister revealed that total revenue for the period is expected to fall short of the targeted $56.17 billion by $1 billion. Because of these developments, government expects a fiscal deficit of $6.36 billion (3.3 percent of GDP) compared to the original $1.5 billion (0.8 percent of GDP).

Table 1: Trinidad & Tobago Key Economic Indicators

Source: IMF, EIU-RBL

Written by: Garvin Joefield

Economist

Republic Bank Limited

Contact

- invest@rfhl.com

-

868-625-3617

Ext. 69919, 69914, 69913, 69911, 69903, 69918 - #8 Rapsey Street Ellerslie Plaza, Maraval. Trinidad and Tobago.