CIS Mutual Funds (SEC)

By RWML

Collective Investment Schemes - A Guide for Investors

It is important as an investor to understand all aspects of the securities industry. Investors can consist of individuals, corporations, governments, pension plans or other entities. Individuals generally invest to obtain a financial return, save for retirement or achieve other financial goals. Despite the purpose, investors may share the same goal of generating high returns whilst minimising risk. In order to do so, it is imperative that investors understand the dynamics of different types of investment products and how their investments can be beneficial to them. In this week’s article, we discuss the Collective Investment Scheme (CIS) market also commonly known as the Mutual Fund market.

What is a CIS?

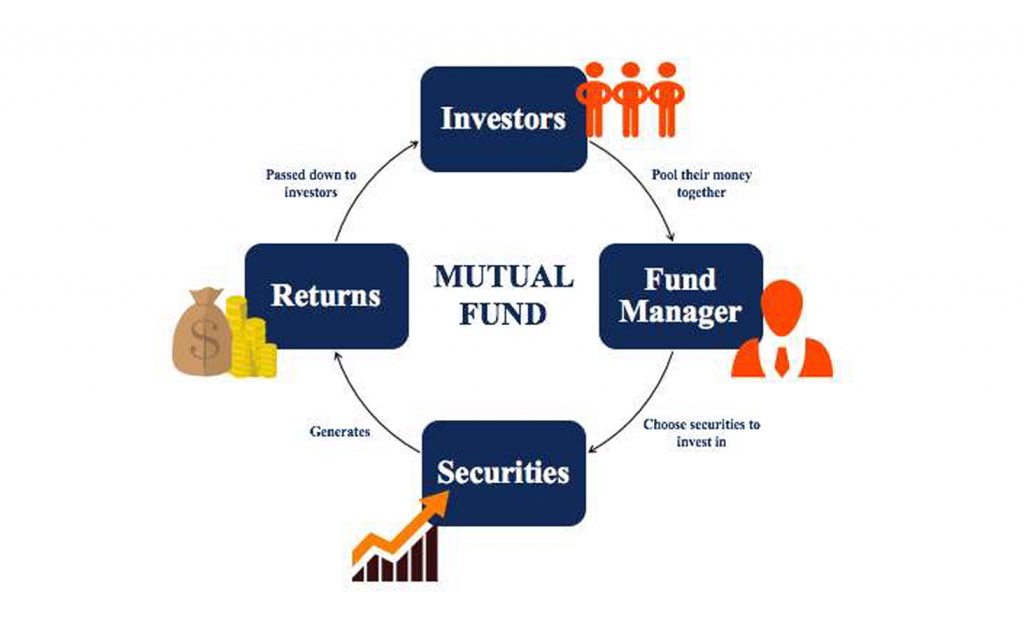

A CIS is generally defined as an investment product whereby investors contribute payments toward a pool of investments (or fund) that is managed by a professional fund manager on behalf of the investors. A person, who contributes payments into a fund, in essence purchases units within the CIS and is thus known as a unitholder. CISs can be defined as either open- ended or closed-ended. Open-ended funds continually create new units and allow unitholders the ability to redeem their units at the prevailing Net Asset Value [1] (NAV). Closed-ended funds are usually listed on an exchange (stock exchange) and have a fixed number of units outstanding so that investors must purchase units from other investors via a secondary market [2] .

[1] The NAV represents the per unit price of the CIS on a specific date or time.

[2] A secondary market is a platform wherein the shares of companies are traded among investors.

How do they work?

When the funds are pooled from investors, the CIS managers then invest these funds in various securities which may include: stocks, bonds, short-term money-market instruments, other securities or assets, or some combination of these investment products. The combined securities and assets managed by CISs are known as its portfolio; which is managed by a CIS Manager. As per the TTSEC CIS Guidelines, no person shall act as a CIS Manager unless such person is approved by the Trinidad and Tobago Securities and Exchange Commission (TTSEC). Each unit within the CIS represents an investor’s proportionate ownership of the CIS’s portfolio and the income the portfolio generates.

Investors in CISs can buy their units from, as well as redeem/sell them to, the CISs themselves. The units are typically purchased from the fund directly or through investment professionals like broker-dealers. Pursuant to the TTSEC’s CIS Guidelines, CISs are required to price their units each business day, in accordance with the methodology set forth in its prospectus [3]. This price, the per-share value of the CIS’s assets minus its liabilities, is called the Net Asset Value (NAV) and can be classified as either Fixed or Floating. For Fixed NAV CISs, as the name suggests, the NAV remains constant. It is usually the responsibility of the CIS manager to maintain the value of a unit for both subscriptions (purchases) and redemptions (sales). For Floating NAV CISs, the value of a unit changes, based on the performance of the pool of securities. CISs must sell and redeem their shares at the NAV that is calculated after the investor places a purchase or redemption order. This means that when an investor places a purchase order for CIS units during the day, the investor will be unaware of the purchase price until the next NAV is calculated.

[3] A prospectus is a formal document that provides details about an investment offering to the public.

Factors to consider before investing

- Determine your financial goals and risk tolerance. Within the local CIS market, there are multiple options for an investor to consider. However, before making this decision, it is prudent to be aware of the investment strategy and risks associated with the CIS and determine if it is a good fit for you. The CISs within the local CIS market are generally classified as Fixed Income funds (bond funds), Equity funds (stock funds), Balanced funds (a combination of Fixed Income and Equity funds) and Other; based on their investment objectives. The first step to successful investing is to determine your current financial goals and risk tolerance—either on your own or with the help of a TTSEC registered investment adviser or broker-dealer. Registered individuals and companies can be searched via our website: https://www.ttsec.org.tt/easi/registered-companies-individuals-and-securities/.

- Be aware of the risks. All investments carry some level of risk. An investor can lose some or all of the money he or she invests – the principal, because securities held by a CIS can fluctuate in value. CISs tend to have different risks and rewards; generally, the higher the potential return, the higher the risk of loss. It is therefore important to periodically review your statements and balances to ensure that you are on track with your investment goals.

- Consider the CIS’s Investment Scheme. Before you invest, it is important to research the CIS you are considering. The CIS Manager’s website is often a good place to begin, and it is helpful to spend some time browsing through the website and review the prospectus to get a better understanding of the CIS Manager’s underlying philosophy on investing. CISs which intend to distribute securities in Trinidad and Tobago must file a prospectus with the TTSEC and make it available to the public. Under the CIS Guidelines it is required that the prospectus discloses a number of matters that are considered to be important to a prospective investor in making an investment decision.

These matters include disclosure of:

- the investment objectives and investment strategies of the CIS;

- a statement on the suitability of the investment for certain types of investors;

- a description of the risk factors specific to an investment in the CIS;

- the fees and expenses payable by the CIS and by holders of securities in the CIS;

- the relationships that the CIS or its manager have with any person, that may give rise to a potential conflict of interest;

- how the NAV is calculated and the frequency of valuation;

- the ten largest holdings of the CIS; and

- a specific warning as it relates to the fund’s performance data is included.

How can CISs provide returns to Investors?

Investors can earn a return from their investments in three (3) ways:

- Dividend Payments—Depending on the underlying securities, a CIS may earn income in the form of dividends based on the portfolio’s performance. The CIS then pays its unitholders nearly all of the income (minus disclosed expenses) it has earned.

- Capital Gain Distributions—When a security that is owned by a CIS increases in price and the CIS decides to sell it, the CIS benefits from a capital gain. At the end of the year, most CISs distribute these capital gains (minus any capital losses) to unitholders.

- Increased NAV/Increased Market Price—If the market value of a CIS’s portfolio increases, after deduction of expenses and liabilities, then the NAV of the CIS, in addition to its shares, increases and the overall value of the investor’s holdings increases. With respect to dividend payments and capital gains distributions, CISs will usually give their unitholders two choices : the CIS can send the investor the payment, or the investor can have the dividends or distributions reinvested into the CIS to purchase more units within the fund (often without paying any additional fees).

Although most CISs have some similarities, their differences may make one option more preferable than the other for each investor. It is hoped that the points raised within this article will equip investors and potential investors with the information they need to make prudent investment decisions.

By:

Business Express Newspaper

Contact

- invest@rfhl.com

-

868-625-3617

Ext. 69919, 69914, 69913, 69911, 69903, 69918 - #8 Rapsey Street Ellerslie Plaza, Maraval. Trinidad and Tobago.

-

For Financial Statements

868-625-3617

Ext. 69907, 63390

©2026 - Republic Wealth Management Limited | All rights reserved